Our Reviews

What clients say about working with us

“The communication was excellent every step of the way. I felt confident and well-informed throughout the entire lending process. It’s great to work with a company that truly understands modern homes and their needs.”

Homeowner

“Taylor and Abby were extremely amazing to work with. Taylor definitely was able to get me the BEST rates out there and Abby was super connected to me and my loan and I felt like she was available any time I needed to connect. Made the experience feel very personable.”

Daniel Wakim

Homeowner

“Taylor and staff are excellent in providing a great service to those seeking a new mortgage.”

Dick Lawrenz

Homeowner

“Working with Taylor is always a great experience. He takes great care of my client’s and is readily available when I need something! Excellent communication, which I highly value!.”

Megan Mackey

Homeowner

“As a realtor working with Taylor and his team at Smart Home Lending has always been a great experience. They stay in contact throughout the process, return phone calls promptly and are always very professional. I would highly recommend them!”

Lorie Wilson

Homeowner

“Working with Taylor has been a great experience. He and his team are very proactive and helpful throughout the loan process. I have had several successful transaction with Smart Home Lending!”

Josh Kirk

Homeowner

“Great Loan Officer and takes really good care of clients!”

Allen Smith

Homeowner

“Nathan Coker and his team were extremely helpful and made the process of obtaining a fair mortgage a breeze. Would highly recommend him for anyone buying a home, first time or otherwise.”

Philip Conners

Homeowner

“Nothing slips through the cracks with Smart Home Lending, as details are always taken care of! Highly recommend!”

Don Ernst

Homeowner

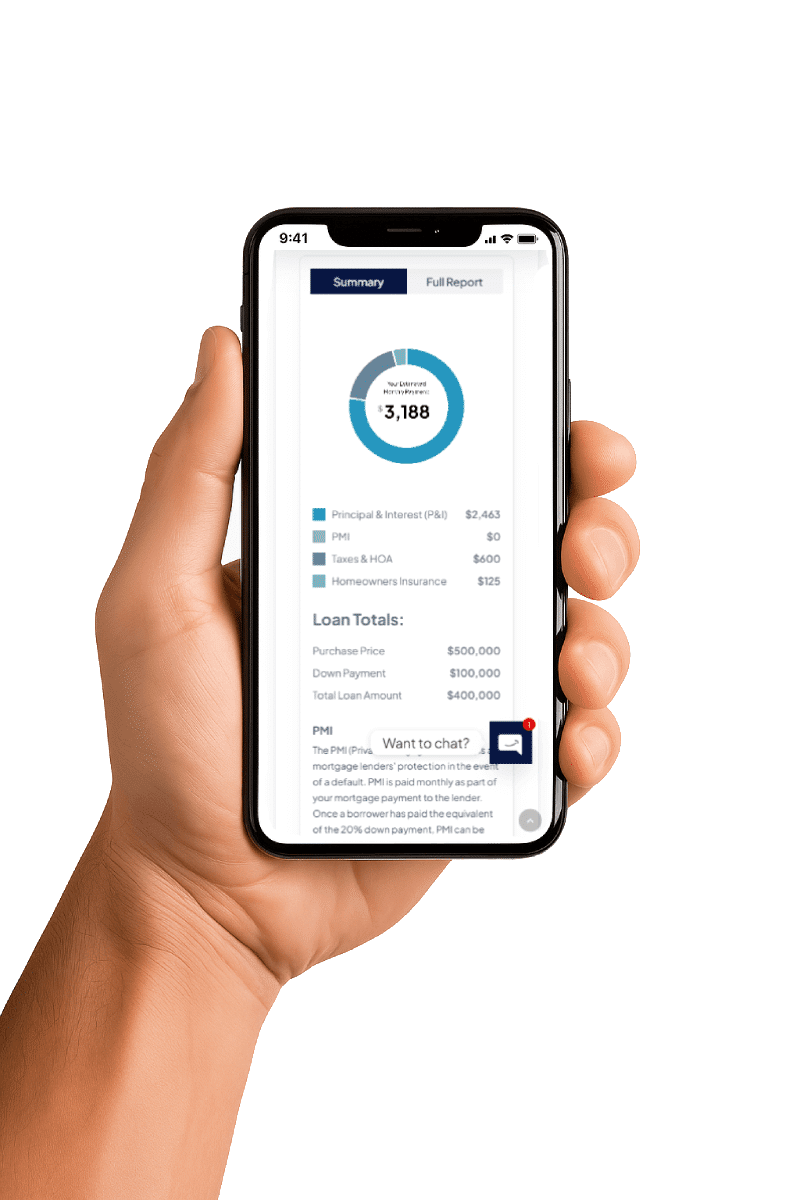

Does renting or buying a home make more sense? Check out what is best for you by using our Rent vs Buy Calculator…

Our mortgage calculators are for demonstration purposes only and may not reflect actual numbers for your specific mortgage. Contact us and we will walk you through the best possible mortgage scenario for your specific needs!

- Monthly rent payments

- Security deposit (typically equal to one month's rent)

- Renters insurance (annual premium)

- Down payment

- Closing costs (typically 2-5% of the home's value)

- Monthly mortgage payments (principal and interest)

- Property taxes

- Homeowners insurance

- Private Mortgage Insurance (PMI) if applicable

- HOA fees (if applicable)

- Maintenance and repairs

- Home improvements and renovations

- Annual home appreciation rate: %

- Annual rent increase: %

- Renters insurance: $ per year

- Home maintenance and repairs: % of home value per year

- Home improvements and renovations: % of home value per year

- Selling costs when you sell the home: % of home value

Smart Home Lending, LLC

NMLS #21440357

We work with over twenty lenders to negotiate you the lowest rate every time. Fast approvals, fast closings, low costs.