Cash-Out or Cash Back Refinance

This plan allows you to refinance your mortgage for more than you currently owe. The difference and the equity is converted into cash for the homeowner.

Homeowner

Daniel Wakim

Homeowner

Dick Lawrenz

Homeowner

Megan Mackey

Homeowner

Lorie Wilson

Homeowner

Josh Kirk

Homeowner

Allen Smith

Homeowner

Philip Conners

Homeowner

Don Ernst

Homeowner

This plan allows you to refinance your mortgage for more than you currently owe. The difference and the equity is converted into cash for the homeowner.

If you currently have a high fixed-rate mortgage and the rates have dropped due to market conditions, then you may want to refinance to a low fixed-rate loan. Also, if you have an ARM, you might consider this option in order to get the security of a fixed rate. Even if your adjustable rate is low now, it is not guaranteed to remain that way; but if you get a low fixed-rate loan, then you lock that low rate in for the life of the loan. This option is a good choice if you are not planning on moving within the next five years.

If your main goal is to quickly build up equity and to pay off your mortgage sooner, then the shorter-term loan is probably your best choice. A lot of times, if you refinance to this type of loan, your monthly payments will be higher, but you will pay substantially less interest and your mortgage will be paid off sooner. Also, you would benefit from a larger tax deduction on interest if you move from a 30-year fixed to a 15-year fixed loan. There are some cases, however, in which you may be able to refinance to a shorter-term loan without raising your monthly payment -if you’ve had your current mortgage for enough years.

If your current monthly payments are higher than is comfortable for your financial situation, then you might want to consider refinancing to a longer-term loan. This will result in a decrease in your monthly payments, since you will have more time to repay the loan. Examining your current mortgage and knowing how you would like to improve it are the first steps you need to take when starting the refinancing process. Once you know this, you can choose the option that will best help you achieve your goals.

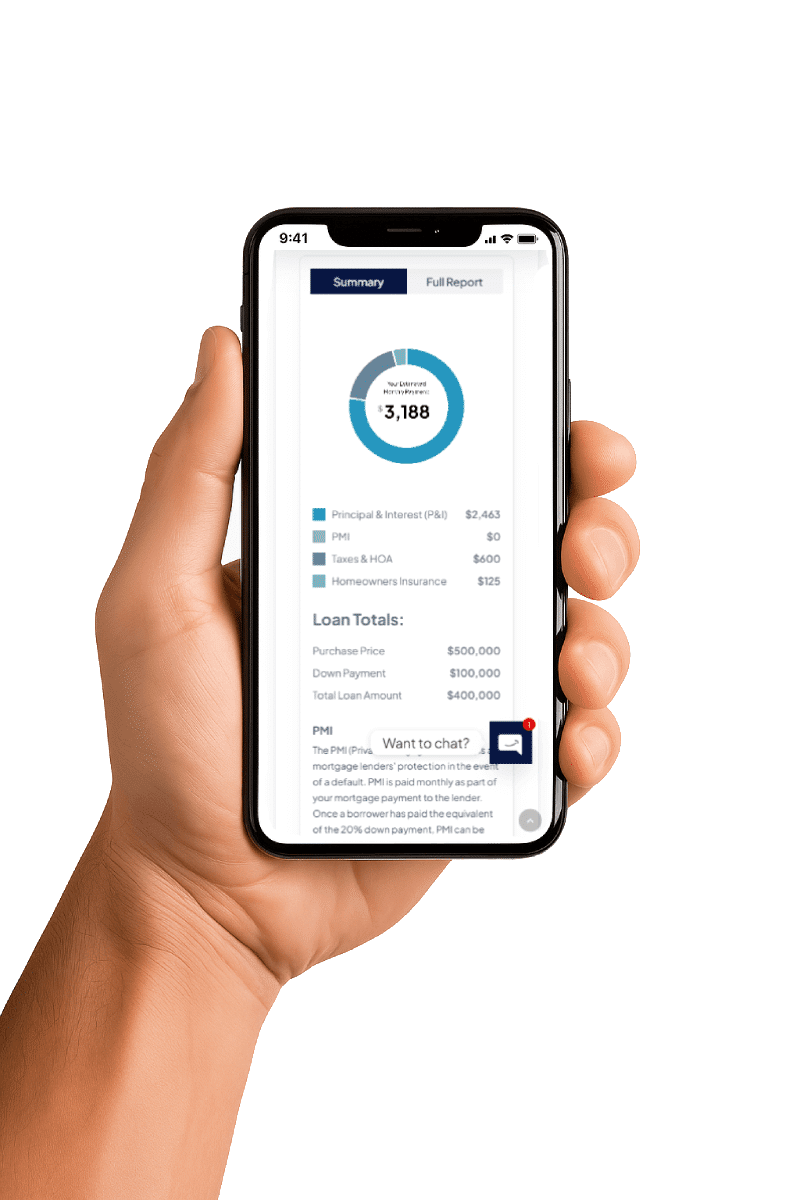

Our mortgage calculators are for demonstration purposes only and may not reflect actual numbers for your specific mortgage. Contact us and we will walk you through the best possible mortgage scenario for your specific needs!

NMLS #21440357

We work with over twenty lenders to negotiate you the lowest rate every time. Fast approvals, fast closings, low costs.

Accessibility Menu | Consumer Grievance Policy | Privacy Policy | NMLS Consumer Access

SMART HOME LENDING, LLC // NMLS #2140357 // 5440 W 110th St Suite 300, Overland Park, KS 66211 – All information is deemed reliable but not guaranteed. Neither mortgage company nor website company shall be responsible for any typographical errors, misinformation, or misprints and shall be held totally harmless. Information is subject to change without notice. This is not an offer for extension of credit or a commitment to lend.

© 2026. Website by LoanSites.

mortgage brokers overland park, interest smart home loans, is it smart to refinance, mark is considering refinancing his mortgage to get a lower interest rate, smart home lending reviews, mortgage refinance cassville, is it smart to refinance your home right now, when is it smart to refinance a mortgage, when is it smart to refinance a house, when is it smart to refinance